Mastering Prop Trading Challenges: A Comprehensive Guide

In the dynamic world of finance, prop trading has emerged as a lucrative avenue for traders eager to harness their skills and potentially earn significant returns. However, the journey in this realm is not without its share of challenges. This article delves deep into understanding prop trading challenges and offers invaluable insights that can help aspiring traders navigate these hurdles effectively.

Understanding Prop Trading

Before diving into the challenges, it's essential to grasp what proprietary trading, or prop trading, entails. In essence, prop trading involves trading financial instruments, such as stocks and derivatives, using a firm’s own capital, rather than clients' funds. The primary objective is to generate profits for the firm, allowing traders to reap rewards based on their performance.

The Appeal of Prop Trading

- Access to Capital: Traders get to leverage the capital of their firm, enabling them to take larger positions than they could individually.

- Profit Sharing: Successful traders often receive a portion of the profits they generate, creating lucrative earning potential.

- Advanced Resources: Firms often provide traders with advanced tools and technologies to enhance their trading strategies.

- Supportive Environment: Many trading firms offer mentorship and collaboration opportunities, fostering growth and learning.

Common Prop Trading Challenges

While prop trading presents great opportunities, it is crucial to acknowledge the challenges that traders frequently encounter. Understanding these obstacles is the first step towards overcoming them. Here are some of the most significant challenges faced by prop traders:

1. Risk Management

One of the most substantial challenges in prop trading stems from risk management. Trading with significant capital can lead to larger losses if not managed properly. Traders must develop robust risk management strategies to protect their capital. Here are some key components:

- Setting Stop Losses: Always have a predefined exit point to minimize losses.

- Position Sizing: Determine the appropriate amount to risk on each trade, keeping in mind your overall capital.

- Diversification: Avoid putting all your eggs in one basket. Spread your investments across different assets.

2. Emotional Discipline

The emotional aspect of trading cannot be underestimated. Emotions such as fear, greed, and impatience can skew judgment and lead to poor decision-making. Maintaining emotional discipline is vital for success in prop trading. Strategies to enhance emotional control include:

- Following a Trading Plan: Stick to your predefined trading strategy to reduce impulsive actions.

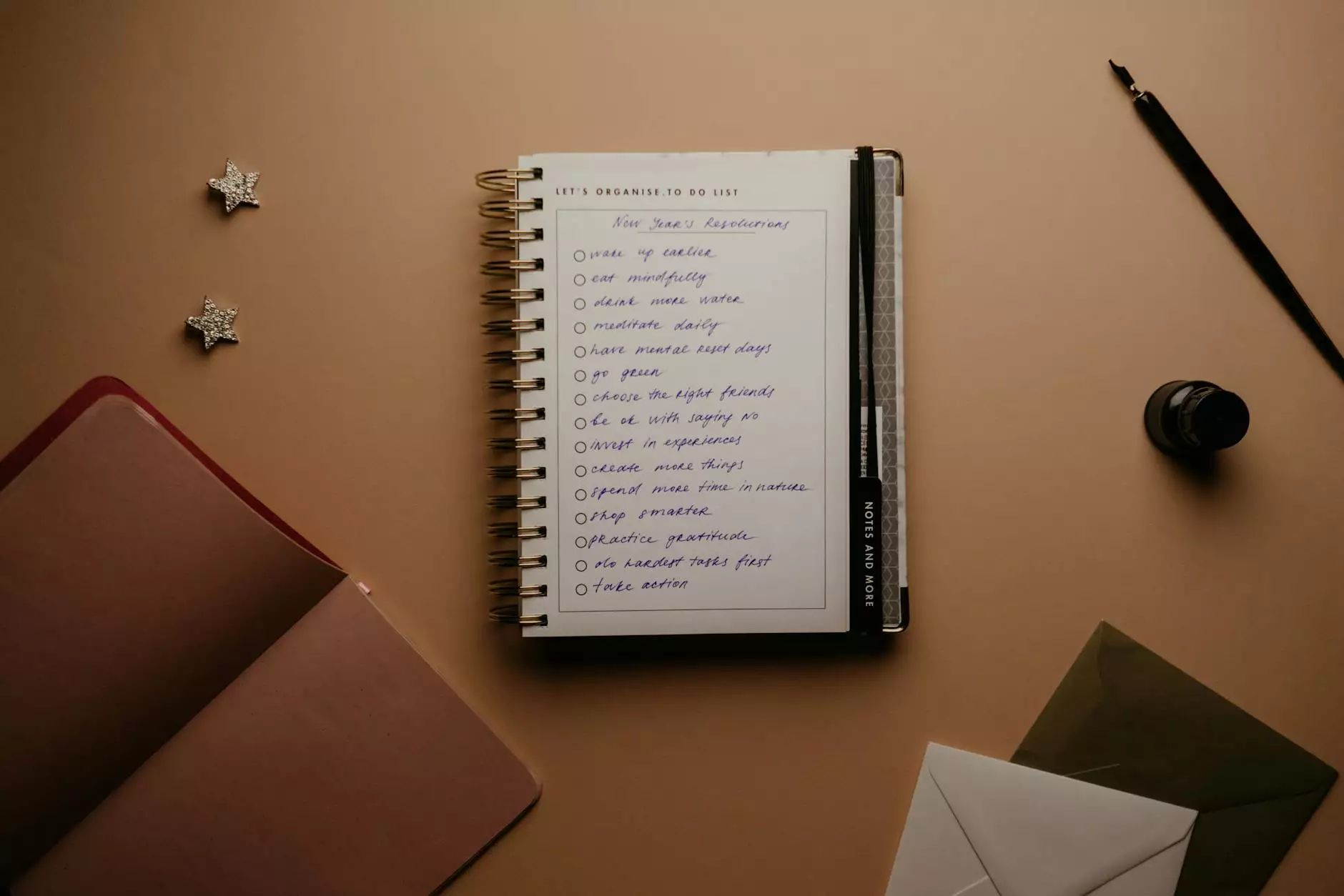

- Practicing Mindfulness: Engage in techniques like meditation or deep breathing to remain centered during trading hours.

- Journaling Trades: Keep a detailed record of your trades and emotions to identify patterns and triggers.

3. Competition

Prop trading firms often attract highly skilled traders, leading to a highly competitive environment. Survival requires standing out from the crowd. Here’s how to thrive in such surroundings:

- Continuous Learning: Always seek to improve your skills through education and practice.

- Networking: Build relationships with other traders to exchange ideas and strategies.

- Leveraging Technology: Utilize advanced trading platforms and tools that provide an edge in market analysis.

4. Performance Pressure

Traders in the prop trading sector often face pressure to deliver consistent results. This can be daunting and may lead to poor choices during trading periods. To manage performance pressure:

- Set Realistic Goals: Determine achievable targets to avoid overwhelming yourself.

- Seek Feedback: Regularly ask mentors or peers for constructive criticism to enhance your performance.

- Prioritize Mental Well-being: Take breaks and ensure a healthy work-life balance to sustain performance levels.

Strategies to Overcome Prop Trading Challenges

Now that we have highlighted the primary challenges, it’s time to explore effective strategies to overcome them. Here are some actionable techniques to navigate the prop trading challenges effectively:

1. Develop a Robust Trading Plan

Having a well-structured trading plan is essential for any trader, especially in prop trading. A solid trading plan should include:

- Market Analysis: Clearly define your methods for analyzing market trends and making trading decisions.

- Risk Management Rules: Outline your approach to risk, including how much capital you are willing to risk on each trade.

- Entry and Exit Strategies: Specify your criteria for entering and exiting trades to keep emotions at bay.

2. Embrace Technology

The financial sector is constantly evolving, and harnessing new technologies can provide a competitive edge. Incorporate modern trading tools and platforms that offer:

- Real-time Data: Stay updated with up-to-the-minute market information to make informed decisions.

- Algorithmic Trading: Consider using algorithms to automate trading processes based on predefined criteria.

- Risk Assessment Tools: Leverage tools that can help you evaluate potential risks before executing trades.

3. Engage in Continuous Education

The most successful traders understand that the learning process never stops. Invest time in:

- Online Courses: Enroll in courses that dive deep into trading strategies and market analysis techniques.

- Webinars and Seminars: Attend industry events to gain insights from experienced traders and experts.

- Books and Articles: Read extensively to expand your knowledge on various trading methodologies.

4. Build a Support Network

An effective support network can provide encouragement and guidance in times of difficulty. Engage with:

- Mentors: Seek out experienced traders who can offer advice and perspectives on market dynamics.

- Peer Groups: Join trading groups or forums to connect with fellow traders for sharing experiences.

- Professional Organizations: Consider joining banking and finance organizations to widen your professional network.

Conclusion

In conclusion, while prop trading challenges can seem daunting, they are not insurmountable. By developing comprehensive strategies, fostering emotional discipline, leveraging technology, and engaging in continuous learning, traders can navigate the complexities of the prop trading landscape and unlock their potential.

Surviving and thriving in the world of prop trading requires dedication and a proactive approach to tackle obstacles as they arise. With the right mindset and resources, you can transform challenges into opportunities for growth within the exciting realm of proprietary trading.